See This Report on Pkf Advisory Llc

Table of ContentsThe Best Strategy To Use For Pkf Advisory LlcExcitement About Pkf Advisory LlcThe 6-Second Trick For Pkf Advisory LlcPkf Advisory Llc - QuestionsPkf Advisory Llc Things To Know Before You Buy

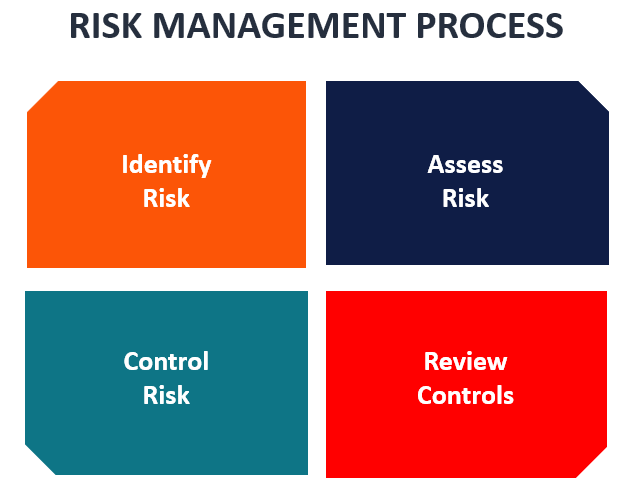

Centri Consulting Risk is an unavoidable part of doing service, however it can be managed via detailed evaluation and administration. The majority of inner and exterior hazards companies face can be resolved and minimized via danger advising ideal practices. It can be hard to gauge your danger direct exposure and use that info to place on your own for success.This blog site is made to help you make the appropriate option by responding to the concern "why is risk advising important for companies?" We'll additionally evaluate inner controls and discover their interconnected partnership with company threat management. Basically, service dangers are preventable interior (calculated) or exterior hazards that affect whether you achieve your organizational goals.

Every service should have a solid danger monitoring plan that details present danger levels and exactly how to minimize worst-case situations. One of the most vital risk advising finest practices is striking an equilibrium in between securing your company while additionally helping with constant growth. This calls for implementing global approaches and governance, like Committee of Funding Organizations of the Treadway Compensation (COSO) inner controls and business risk management.

4 Simple Techniques For Pkf Advisory Llc

Among the most effective ways to take care of risk in organization is via quantitative analysis, which utilizes simulations or statistics to designate risks particular numerical values. These thought values are fed right into a threat model, which generates a variety of results. The outcomes are analyzed by risk supervisors, who utilize the data to identify service opportunities and alleviate negative outcomes.

These reports also consist of an examination of the impact of adverse end results and reduction plans if damaging occasions do occur - pre-acquisition risk assessment. Qualitative danger devices consist of reason and impact diagrams, SWOT analyses, and choice matrices.

With the 3LOD design, your board of directors is accountable for risk oversight, while elderly management develops a business-wide danger society. Liable for possessing and mitigating threats, operational managers oversee day-to-day business transactions.

Indicators on Pkf Advisory Llc You Need To Know

These tasks are normally dealt with by economic controllership, quality assurance teams, and compliance, who might likewise have responsibilities within the very first line of protection. Interior auditors give objective guarantee to the very first 2 lines of protection to make sure that risks are taken care of appropriately while still satisfying functional objectives. Third-line workers ought to have a direct partnership with the board of directors, while still maintaining a connection with monitoring in monetary and/or lawful capabilities.

A detailed collection of interior controls must include things like settlement, documentation, safety, consent, and separation of tasks. As the variety of ethics-focused financiers proceeds to enhance, many companies are adding environmental, social, and governance (ESG) standards to their internal controls. Capitalists make use of these to figure out whether a company's worths straighten with their own.

Social standards examine just how a company manages its connections with workers, consumers, and the bigger neighborhood. They also increase effectiveness and boost conformity while improving procedures and helping avoid fraudulence.

The Single Strategy To Use For Pkf Advisory Llc

Constructing an extensive set of interior controls entails approach positioning, systematizing policies and treatments, process documentation, and developing roles and obligations. Your inner controls need to integrate threat advisory finest methods while always continuing to be focused on your core company objectives. The most effective interior controls are purposefully segregated to avoid prospective problems and minimize the risk of financial fraud.

Creating excellent internal controls involves applying policies that are both preventative and investigator. They consist of: Limiting physical accessibility to equipment, inventory, and money Separation of duties Authorization of invoices Confirmation of expenditures These backup procedures are made to spot adverse end results and threats missed by the first line of defense.

Internal audits entail a complete assessment of click here to read a service's internal controls, including its accounting practices and company management. They're created to make certain regulative conformity, along with exact and timely economic reporting.

The smart Trick of Pkf Advisory Llc That Nobody is Talking About

According to this regulations, monitoring groups are legally in charge of the precision of their company's economic declarations - restructuring and bankruptcy services. Along with securing capitalists, SOX (and interior audit support) have substantially boosted the integrity of public accountancy disclosures. These audits are carried out by unbiased 3rd parties and are designed to evaluate a company's accounting procedures and interior controls